Our May 2024 Newsletter: Appeal of the 60/40 Portfolio

Submitted by Saratoga Financial Services on May 9th, 2024

Appeal of the 60/40 Portfolio

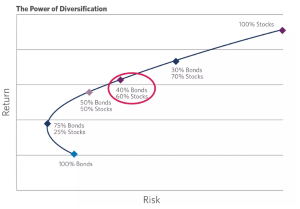

What is a 60/40 portfolio? It is a portfolio that includes 60% stocks (equities) and 40% bonds (fixed income) asset allocation exposure. Stocks can be diversified across different industries, sectors, sizes and geographies.

Fixed income securities can also be diversified using government bonds, corporate bonds, international bonds (government and corporate), and money market instruments.

Research conducted found that by combining assets with different risk and return characteristics, such as stocks and bonds, investors could construct portfolios that offered superior risk-adjusted returns compared to portfolios constructed from an individual asset class.

By allocating most assets to stocks, which historically have provided higher returns over the long term (but with greater volatility) and complementing them with fixed bonds, which offer stability and income, investors could experience a smoother path through market swings while still capturing the upside potential of stocks.

Historically, the 60/40 portfolio has effectively generated wealth while helping mitigate portfolio risk.

Here at SFS, we embrace the 60/40 allocation where we see it fits with our client’s risk level and goals.

To learn more about the power of diversification, click here to read “The Ongoing Appeal of the 60/40 Portfolio.”

Note: Sample only. Not meant to represent any investment or specific portfolio.

RMD Waiver Update

The Internal Revenue Service (IRS) has waived required minimum distributions (RMD) in 2024 for beneficiaries under the 10-year rule. The 10-year rule requires the entire inherited IRA balance to be withdrawn by the end of the 10th year after death. However, IRS proposed regulations from February 2022 added a second requirement for beneficiaries who inherit IRAs from those who died after reaching their required beginning date (RBD) for taking RMDs. (The RBD is generally April 1 of the year after the year the IRA owner turns 73.) The IRS said this group of beneficiaries also must take annual RMDs for years one through nine of the 10-year term. This provision has been very controversial and confusing. Recognizing this, the IRS for the fourth straight year has waived those RMDs by saying there will be no penalty for failing to taking them. In Notice 2024-35, the IRS also says that it finally expects to finalize its proposed SECURE Act regulations, issued in February 2022, so they will be effective starting in 2025.

There is a special category of beneficiaries called eligible designated beneficiaries, who are not subject to the 10-year rule and are still eligible for a stretch IRA, which allows you to take required minimum distributions (RMDs) over their life expectancy based on age. Contact our office for more details on this special category.

Here at SFS we are monitoring this update and once there has been an official ruling, we will be sure to be in touch with those affected.

If you have any questions, please call our office at (518) 584-2555.

Did You Know?

- Required Minimum Distributions (RMD) are calculated by dividing the retirement account's prior year-end fair market value by a life expectancy factor published by the IRS. 1

- Failure to take RMDs as currently required results in a 25% penalty.

- Accounts that require RMDs include- traditional IRA, SEP IRA, SIMPLE IRA and 401(k) retirement plan accounts.

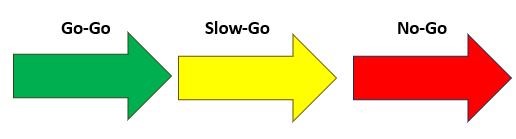

How To Plan For Retirement: Go-Go, Slow-Go, No-Go Years

One phase of retirement planning that can be over looked is determining what activities will help keep you busy and fill your days once you are retired. The Kiplinger article, “How to Plan for Retirement’s Go-Go, Slow-Go and No-Go Years" illustrates these 3 phases and how your social retirement plan should correlate with your level of physical fitness and ability.

Of course, financial planning for retirement is crucial but so is having a realistic plan for your Go-Go, Slow-Go and No-Go years which can help shape your retirement journey to be graceful and satisfying. Click on the article above to read more about these 3 phases.

See You Tomorrow!

Tomorrow we will be hosting our 13th annual Shred Event from 9am to 11am in the JC Penny parking lot at The Wilton Mall.

A special thank you to Confidata, the on-site professional shredding service and members of the Saratoga Springs High School Tennis program.

If you have any questions, please call the office at (518) 584-2555.

Sources:

1. Investopedia

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

Asset allocation does not ensure a profit or protect against a loss.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

The market value of corporate bonds will fluctuate, and if the bond is sold prior to maturity, the investor’s yield may differ from the advertised yield.

Government bonds are guaranteed by the US government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value.

Contributions to a traditional IRA may be tax deductible in the contribution year, with current income tax due at withdrawal. Withdrawals prior to age 59 ½ may result in a 10% IRS penalty tax in addition to current income tax.