Our June 2024 Newsletter: What Happens Financially When You Work One More Year?

Submitted by Saratoga Financial Services on June 10th, 2024

What Happens Financially When You Work One More Year?

Determining when to retire is one of life’s biggest decisions. Reviewing your finances, lifestyle, goals and “playing out” various potential scenarios for retirement with your financial advisor can help guide your decision.

One question that may quickly arise could be - what would my finances look like if I put retirement off one more year?

An obvious upside to that decision is that you would have an extra year of saving. You may be at the peak of your earning potential and have fewer expenses, such as having your home paid off or your now adult children are off your payroll, which can be a meaningful extra year of saving.

Weighing the pros and cons of a shorter retirement vs. not feeling like you have financial freedom can be intimidating. Knowing the potential scenarios may help you feel more confident as you approach retirement.

Click here to read the article, "Using Financial Modeling To Find Out If You Should Work Another Year" for more insight on this scenario.

We are always here to help at SFS, therefore please to reach out with questions or to schedule your upcoming retirement planning meeting.

Did You Know?

- The average retirement age in the United States for 2024 is 62, in 2002 was 59 and in 1991 was 57. 1

- In 2022 the average retirement savings for ages 55-64 was $537,563. 2

- In 2022 the average retirement savings for ages 65-74 was $609,229. 3

- 62% of workers 65 or older are working full time, compared with 47% in 1987. 4

Consolidating Investment Accounts to One Advisor

Being able to have all your investment accounts under one roof certainly has its perks. Apart from making your life easier by having just one financial advisor’s office to contact, other benefits include:

- A complete view of your investments

- Being able to track tax opportunities

- Possibly able to reduce fees and eliminate commissions

- Effective planning

To learn more about holding your investments at a single financial office click here to read “4 Reasons to Consolidate Accounts.”

If you are thinking of consolidating your outside accounts into SFS, don’t hesitate to call and we will be more than happy to assist you the transfer process.

People Who Stay Young at Heart Adopt These 9 Daily Habits

Retirement is a new beginning and the root of your youth does not lie in your physical age but rather in your attitude towards life.

While in your retirement era you can practice simple daily habits that can keep you feeling young and vibrant regardless of your age.

Click here to read “People Who Stay Young at Heart in Their Retirement Years Usually Adopt These 9 Daily Habits.”

Here at SFS we enjoy creating relationships with our clients so feel free to share if you have any fun tips on staying active throughout your retirement and what you find joy in doing.

Thank You!

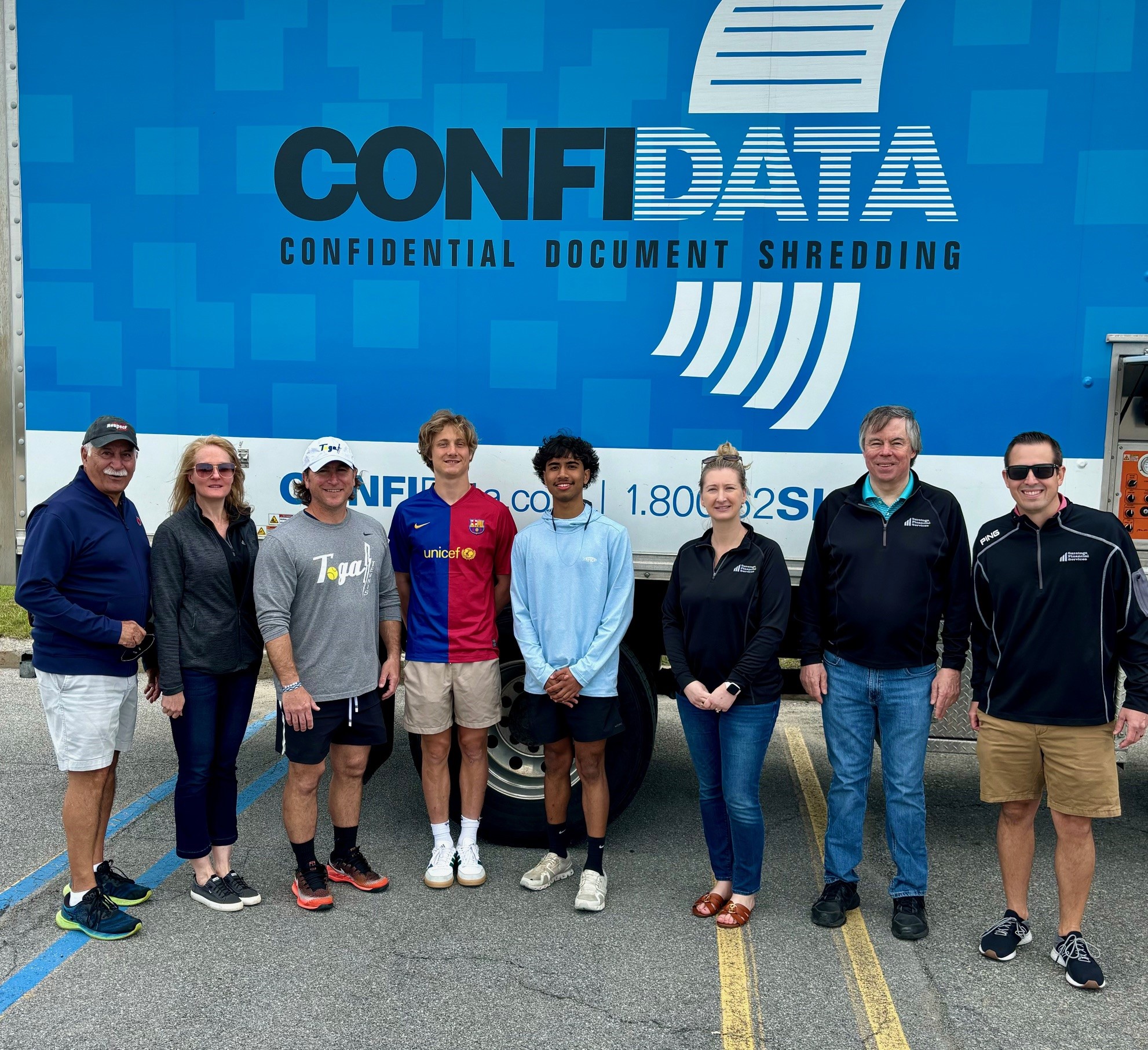

On Saturday, May 4th we hosted our 13th annual Shred Event and we are happy to announce that it was another successful year!

We had over 100 cars come through to say hello and shred their confidential documents.

We wouldn’t be able to achieve such success without the help of Confidata, the onsite professional shredding service who provides their shred truck that helps us quickly destroy the given files.

A big thank you to this year’s volunteers- the Saratoga Springs High School Tennis program who helped transfer the files and boxes to the shred truck.

As well as our sponsors- The Wilton Mall, Saratoga County Chamber of Commerce and The Saratoga Business Journal.

Keep an eye out for the date of our 14th annual Shred Event next Spring.

Pictured above from left to right: Rich Johns of Act With Respect Always, Amanda Friedman, Coach Tim O’Brien with 2 Tennis players, Jamie Usas, Bob Schermerhorn and Drew Chapman of SFS.

Sources:

1. Mass Mutual & Gallup Poll

2-3. Federal Reserve 2023

4. Pew Research Center