Our July 2024 Newsletter: Using The S&P 500 as a Benchmark Isn't Appropriate for Everyone

Submitted by Saratoga Financial Services on July 10th, 2024Using The S&P 500 as a Benchmark Isn't Appropriate for Everyone

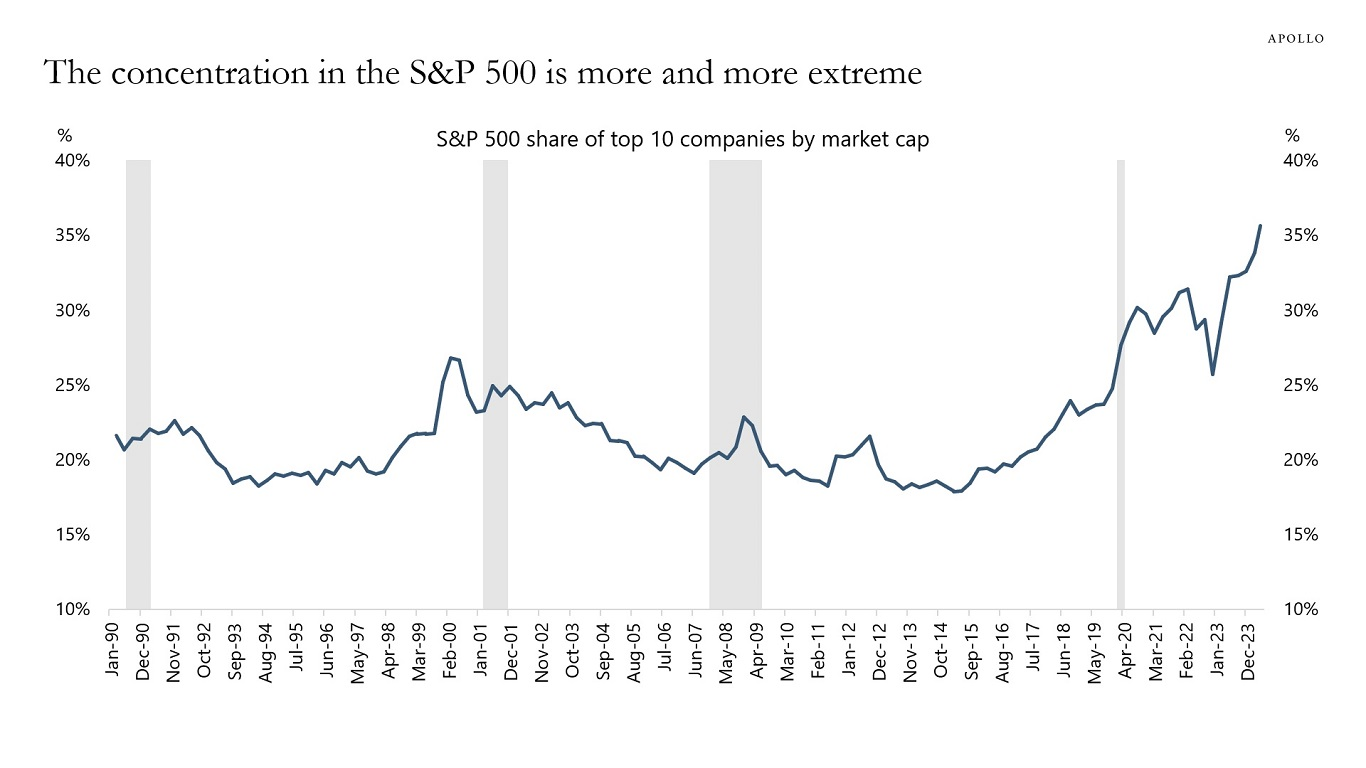

The S&P 500 (Standard and Poor’s 500) and DJIA (Dow Jones Industrial Average) are commonly discussed stock indexes which can sometime be used as benchmarks for investment portfolios. This style of investing assumes the investor is fully invested in that asset class (stocks). Recently the top 10 stocks in the S&P 500 make up over 30% of the index which shows how concentrated sectors can drive the index’s performance but also create sector specific and company specific risks.

Another less commonly discussed index is the Barclay’s US Aggregate Bond which is a bond index. Depending on your investment objective, creating a blend of investments, both stocks and bonds may be more appropriate for your portfolio which should then be compared to a blended benchmark. Otherwise, you may be attempting to compare “apples to oranges” if you use the S&P 500 to benchmark a portfolio that contains bonds. This is a good reason to talk with a financial professional to determine the appropriate benchmark for your personal investment portfolio.

If you own a better-diversified portfolio rather than solely U.S. stocks, your portfolio likely hasn’t kept up with the stock market recently. Well-diversified portfolios include a variety of investments and aren’t designed to outperform the S&P 500. The objective is to build a portfolio that allows you to achieve your goals for retirement and other financial goals — while taking into account your risk tolerance and time horizon. An equity index has a narrow scope of investments and lacks the degree of diversification used in retirement and investing which has a specific goal.

For more information on benchmarking with the S&P 500, click here to read “Why Do Investors Use the S&P 500 as a Benchmark.”

If you have any questions or would like more insight, please call our office at (518) 584-2555.

Did You Know?

- The S&P 500 index was launched in 1957 by the credit rating agency Standard and Poor's.

- The S&P 500 index includes 500 leading U.S. companies, representing only about 80% of the U.S. stock market and only about 42% of the global stock market. Additionally, the index is weighted by float-adjusted market capitalization which means that larger companies end up being a larger portion of the index, making it less of an apples-to-apples comparison for the global market. 1

- In order to qualify for the S&P 500, a company must be publicly traded and based in the United States. It must also meet certain requirements for liquidity and market capitalization and have a public float of a least 10% of it’s shares. As well as have positive earnings over the trailing 4 quarters.

Drew's 10th Anniversary

Join us in congratulating Drew Chapman on his 10th anniversary here at Saratoga Financial Services!

Drew joined our office in July of 2014 as our Operations Research Associate.

He assists with our investment research, account servicing, analyzing portfolios and developing asset allocations for your portfolios!

We thank him for all his dedication throughout the past 10 years to SFS.

Drew’s email is A.Chapman@lpl.com if you would like to send him a note.

Account View Upgrade

Account View is an online secure portal offered through LPL Financial where clients are able to view the status of their portfolio and find account related documents.

Starting this month, July 2024, there will be an Account View upgrade, where users will migrate from Account View 1.0 to Account View 2.0.

New features within Account View 2.0 include- a modern dashboard with a simpler view of your account information, a mobile app to be able to download to your cell phone or tablet as well as more e-delivery paperless options for forms and letters.

Account View 2.0 will also give you access to new self-serve features such as being able to update beneficiary information, mobile check deposits and more!

To enroll or learn more about the new Account View 2.0 upgrade, please call our office at (518) 584-2555.

Summertime In Saratoga Springs

It is officially sweet Summertime in Saratoga Springs! The weather has certainly prepared us for the summer months ahead as well as the successful Belmont Stakes that were held at the Saratoga Race Course in June. Beginning Thursday, July 11th will start the Saratoga Race Course racing season for this summer through Labor Day.

The Saratoga Performing Arts Center, better known as SPAC, will also be hosting annual favorites this month like The Dave Matthews Band and The New York City Ballet in addition to Impractical Jokers, REO Speedwagon and Kidz Bop.

Apart from the horse racing and concerts, summer fun can be found at Saratoga Lake, outdoor dining spots, farmers markets, the music in Congress Park and more!

Click here to check out Saratoga Springs Summer Guide!

Source:

1. betterment.com