Our February 2024 Newsletter: How Much Will You Spend in Retirement?

Submitted by Saratoga Financial Services on February 7th, 2024

How Much Will You Spend in Retirement

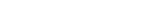

Living the retirement lifestyle you have been planning for many years can still require a budget. Expenses are unavoidable in retirement especially when looking at housing and healthcare costs. Depending on your income and retirement lifestyle, you may expect to pay between 55% and 80% of your annual income every year throughout retirement.

In the age range when most are retired, age 65 and older, there is a significant drop in overall spending, therefore, as people age into retirement, their spending patterns change depending on their needs and wants. While the spending on entertainment and transportation remains stable, spending on housing tends to go down and spending on health care goes up. Lifestyle is another big factor to consider when estimating how much you will spend in retirement. Click here to read “How Much Will You Spend In Retirement?” for more insight.

If you need assistance with your retirement budget, don't hesitate to call the office at (518) 584-2555.

By The Numbers

- According to the most recent Survey of Consumer Finances, the average 65 to 74-year-old has a little over $426,000 saved in retirement accounts. (1)

- The average retirement age in the United States is age 64. (2)

- Nearly 80% of those ages 65 and older own their homes. (3)

When To Expect LPL Financial Tax Forms

As we enter tax season, below is information of when you can expect your LPL Financial tax forms in the mail.

Keeping in mind- if you have opted for paperless tax forms, you will have your documents available in your Account View.

1099-R/Q - will be mailed on January 19 (this applies to retirement account distributions)

Consolidated 1099 Tax Statement - Tax form reporting income and transactions for non-retirement accounts (i.e., Individual, Joint, TOD, Trust)

During the 2023/2024 tax season, LPL will mail 1099 consolidated tax statements in multiple waves (similar to other major financial firms) to meet all IRS deadlines, reduce errors, and cut down on the need to mail corrected forms.

See important tax season mailing dates below for a full list of mailing dates. Your original 1099 consolidated tax statement will be mailed shortly after we receive final income reclassification announcements from all securities held in your account. Timing of receiving final income reclassification data may result in your tax statement not arriving on the anticipated February date. In these cases, your 1099 tax statement will be mailed between February 16 and March 15, 2024.

If your 1099 consolidated tax statement is not available on or before February 16, 2024, you’ll have access to a Preliminary 1099-Consolidated Tax Statement. This is an advanced draft only. Data may be incomplete and is subject to change. The preliminary 1099 should not be considered final and should not be used for the purpose of filing a tax return with the IRS or with any state or other regulatory agency. The preliminary form will be available electronically and won’t be mailed. You can access a preliminary 1099-consolidated tax forms statement in Account View or by reaching out to our office.

- January 19 & 26 - Non-retirement accounts with the simplest tax information.

- February 2, 9, 16 & 23 - Non-retirement accounts with more complex securities and those where security issuers provided final documents to LPL late.

- March 1, 8 & 15 - Non-retirement accounts where the security issuers provided tax information to LPL late.

Form 5498 IRA - will be mailed on February 23 and May 24 (this shows contributions made to your IRA including any rollovers in 2023. This form is informational and not needed to file your tax return)

If you have any questions regarding your tax forms, please call the office at (518) 584-2555.

Belmont Stakes Coming to Saratoga Race Course!

The Belmont Stakes Racing Festival will be held at Saratoga Race course June 6th-9th 2024.

The 4-day festival will include 23 stake races with purses totaling $10.1 million, the highest winnings since the launch of the multi-day Belmont Stakes Racing Festival in 2014.

The race on Saturday June 8th will be the 156th running of the Belmont Stakes, which is the final jewel of the Triple Crown.

The Belmont traditionally follows the Kentucky Derby and the Preakness as part of racing’s Triple Crown for 3-year-olds. Only 13 horses have won all three races, including Whirlaway, Secretariat, Seattle Slew and, most recently, Justify in 2018.

Our home town track has earned the nickname of “Graveyard of Champions”, where upsets have happened with Man o’ War and the Triple Crown winners Secretariat and American Pharoah all losing at the Saratoga Race Course.

The Belmont Stakes started at Jerome Park, which is now the north Bronx, in 1867. The race then moved to Morris Park, also located in the Bronx, in 1890 before moving to a newly built Belmont Park in Nassau County in 1905. The race was held at Aqueduct from 1963 to 1967 while Belmont was undergoing previous renovations.

Tickets are set to go on sale Thursday, February 15th at 10am, so if you are interested in witnessing this highly anticipated event, be sure to keep an eye out for more announcements. More information on the Belmont Stakes can be found here.

Fun February Events

It may be 20 degrees and snowing but that doesn’t stop the fun around Saratoga Springs this month. Starting at 11am on Saturday 2/10 you can venture around the 25th Annual Saratoga Chowderfest right in downtown Saratoga Springs!

Valentine’s Day is also coming up and some of the best restaurants in town are providing Valentine’s Day specials.

Click here to view more of the indoor and outdoor activities around town this month.

Sources:

1. Federal Reserve

2.Yahoo Finance

3. Joint Center for Housing Studies of Harvard University