Our April 2024 Newsletter: When To Trigger Social Security

Submitted by Saratoga Financial Services on April 8th, 2024

When To Trigger Social Security

One of the most common questions we are asked when retirement planning or reviewing portfolios with our clients is, “when should I trigger Social Security?” The answer is - there is no perfect universal answer. Each client must consider specifics such as their current cash flow needs, health status, family’s longevity and whether they plan to work in retirement or if they have other sources of retirement income.

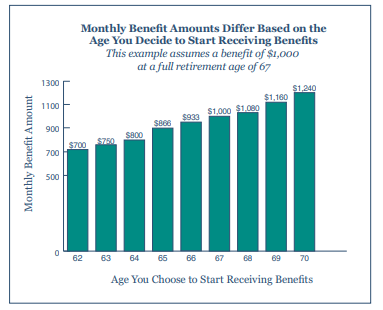

When it comes to your Social Security benefits, mainly the 2 ways of looking at it would be either receiving benefits early with a smaller monthly amount for more years or wait for a larger monthly payment in a shorter timeframe.

Source: Social Security Administration

The above chart shows an example of a $1,000 check and the difference if you trigger prior to the full retirement age or if you were to hold off and trigger past the full retirement age. This example shows someone born 1960 or later for a full retirement age of 67.

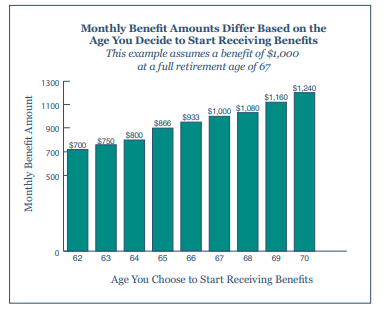

Which leads to the next question of- when is your full retirement age?

You are able to claim your benefits as early as age 62 or may wait until as late as age 70. After age 70, you will not receive any bigger benefit for delaying any longer.

Determining your full retirement age is important because as you approach retirement you will want to look at your future needs and how your Social Security benefits can help positively impact your finances once retired.

If you have any questions on when you should trigger Social Security or need assistance on calculating your full retirement age, you are more than welcome to call the office at (518) 584-2555.

To learn more about the possibilities that come along with Social Security benefits, click here to read “Social Security retirement age: When to take Social Security benefits.”

By The Numbers

- About 1 out of every 3 65-year-olds today will live until at least age 90, and 1 out of 7 will live until at least age 95. 1

- Your Social Security benefit is your calculated average monthly earnings during the 35 years in which you earned the most.

- In 1998, the average retired worker claimed Social Security benefits at 63.4 (men) and 63.5 (women). 2

- In 2018, the average retired worker claimed Social Security benefits was 64.7 (men) and 64.6 (women). 3

- In 2022, the average retired worker claimed Social Security benefits at 65.0 (men) and 64.9 (women). 4

- The average benefit awarded to a new retiree in 2022 was $1,938.75. 5

What To Shred vs. What To Keep

It’s that time of year again-we are happy to host our annual Shred Event!

This will be our 13th Shred Event, open to all our clients and community members.

Join us on Saturday May 4th from 9am to 11am in the JC Penny back parking lot at The Wilton Mall where you can safely dispose of your old documents and confidential files.

Partnering again this year with Confidata, an on-site confidential document shredding company where after the paper is securely destroyed it is recycled and made into everyday products such as paper towels and tissues.

Excited to also have the help of the Saratoga Springs High School Tennis Program this year to help unload your files into the shred truck. Monetary donations will be graciously accepted to benefit their program.

This event is free of charge, rain or shine! We ask for a 5 box limit and items not accepted include books, hard covers, cardboard and magazines.

As we progress more and more with electronic record keeping, you may find yourself holding onto statements and documents longer than recommended. Click here to look at the list of items that you should hold on to for a few more years or items that are able to clear space in your filing cabinets.

If you have any questions, please call our office!

Upcoming Shred Event

Sources:

1.SSA.Gov

2-5. Motley Fool