Our January 2024 Newsletter: Outlook 2024: A Turning Point

Submitted by Saratoga Financial Services on January 8th, 2024

Outlook 2024: A Turning Point

Happy New Year! A New Year provides us with an opportunity to set new goals and achieve new successes while reflecting on the previous year’s intent and accomplishments. The LPL Financial Research team has published their Outlook 2024: A Turning Point, which recaps where markets have been over the last half of 2023 to help position your portfolio through midyear of 2024.

The past 2 years we have focused on inflation, market volatility and striving for a sense of economic balance.

In year 2024, researchers believe the markets will make a definitive turn to a more recognizable place and a more familiar, steadier economy and market patterns.

Surely there will be some surprises and possible challenges since the market likes to remind us it is constantly overcoming obstacles.

Click here to read the entire Outlook 2024: A Turning Point.

If you have any questions, please contact the office at (518) 584-2555.

4% Withdrawal Rule

Often heard throughout your retirement portfolio reviews is the “4% Rule”, referring to a popular retirement withdrawal strategy. Why 4%? The strategy suggest that a retiree can safely withdraw 4% from their retirement savings each year for them to last up to 30 years.

Safe to say we can agree that we do not want to outlive our retirement savings and that nightmare can become a reality when in retirement, retirees are taking too high of a withdrawal rate and burning out their accounts rather quickly. Each retiree’s financial situation varies and the 4% Rule does not account for things such as medical expenses, market fluctuations and tax rates but it is looked at as a financial rule of thumb. The concept of the 4% Rule is attributed to financial advisor William Bengen who published his findings in 1994 and interestingly enough, his analysis of the 4% Rule would have stood up to the stock market crash of 1929, the Great Depression, World War II and the double-digit inflation seen throughout the decade in the 1970s.

Keeping in mind, the 4% Rule is a guideline, not a guarantee, but benefits include:

- Simplicity: It's easy to understand and implement, making it a good starting point for retirement planning.

- Sustainability: Based on historical data, the 4% Rule has a high probability of allowing your retirement savings to last for 30 years or more.

- Flexibility: You can adjust the withdrawal rate based on your individual circumstances, such as your lifespan, health, and risk tolerance.

For a better understanding of the 4% Rule, click here to read the article " What Is The 4% Rule for Withdrawals in Retirement and How Much Can You Spend?"

When the time comes that you would like a withdrawal from your accounts here with us, call us at (518) 584-2555 and Jamie or Drew would be happy to assist you!

Smart Investing

Being a smart investor is more than just buying popular assets. We understand it can be challenging to see a certain stock outperform others or watch as the stock market fluctuates and think “should I go cash on my accounts until the market bounces back?” Here at SFS we like to guide and educate our clients and the general public as much as possible. Common trends that we see that can hurt your retirement accounts include:

Constantly watching the markets: It is normal to keep an eye on what is happening in the economy but it is easy to get caught up in the excitement or gloom of it all if you’re tracking your accounts daily or weekly.

Chasing the hottest trends: Over the years we have seen certain investment trends become popular but not always stick it out for the long haul. A reason as to why we push to consider a more long-term commitment with investing.

Bad advice from social media or news headlines: It is easy to find misinformation online surrounding investing, finances and the future of the economy. Just remember, those outlets don’t know your financial situation and definitely don’t have a crystal ball to see the economic future.

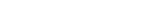

Did You Know: Timing The Market Is Impossible and Can Be Costly:

Past performance does not guarantee future results. Indices are unmanaged and not available for direct investment. For illustrative purposes only. Data Sources: Ned Davis Research, Morningstar, and Hartford Funds, 2/23

Still Waiting for Final RMD Regulations for Non-Spousal Inherited IRAs

For those who inherited an Individual Retirement Account (IRA) after 2019, final regulations will be issued at a later date regarding 2024 Required Minimum Distributions (RMDs) but most still must empty the account by the end of the tenth year following the original owner’s death.

The Internal Revenue Service postponed releasing final rules on RMDs for inherited IRAs and announced in July 2023 a delay of final rules governing inherited IRA RMDs — to 2024. We will continue to monitor the rule release this year.

Winter Fun

Perhaps you head South to a sunnier destination or perhaps you stick around Saratoga Springs and enjoy the winter fun throughout the area. You are able to find ski mountains, sledding hills, frozen lakes for ice skating and solid ground for snow shoeing. Click here to explore the Saratoga Winter Guide.

Head North and you will find Lake George’s Winter Dream held at Fort William Henry where you will find wintery lights, music and interactive moments. For tickets and more information, click here.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.